Short Term

Your professional will learn about your goals, your lifestyle, and your finances. They may ask for more information about your financial decision-making process.

Long Term

A good plan is not a one-and-done task. The best professionals will work with you regularly to reassess your situation and discuss how your goals may have shifted.

Expertise and Value Proposition

This helps you understand their value proposition, such as better client service, unique investment philosophy, specialized expertise, or something else. Look for specifics, not generalities.

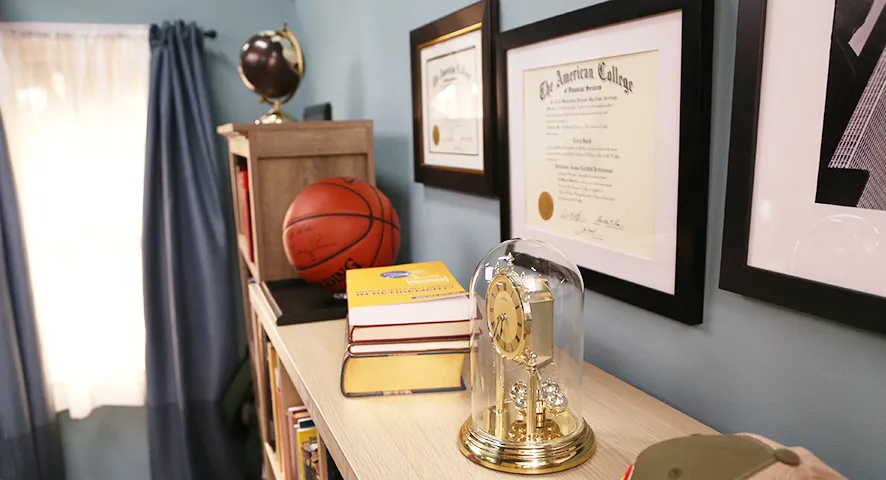

Professional designations (such as the ones listed on this site) indicate applied knowledge and/or specialization, which typically align to services offered. Ask what each credential means and how it relates to your financial goals.

Experience can influence the quality of the professional’s advice and their ability to navigate complex situations. Ask the professional about their background, their clients, and how long they’ve been in the field.

Understanding their core beliefs (such as passive vs. active investing) helps determine if their approach aligns with your preferences and risk tolerance.

An advisor won’t mind sharing references if you ask. Also, ask about their track record, particularly if they will be handling investments for you. Very few investors beat the market consistently, but ethical financial professionals will be upfront about their strategies and the opportunities they can offer.

If you found your professional through our tools , you can be certain their credentials are verified. You can also check a professional’s credentials with our designation check and verify they have no adverse history through FINRA, the SEC, or your state regulators.

Beyond growing and protecting your wealth, some financial professionals also have deep expertise in helping you make an impact for your favorite charities, ensure a smooth transition for your business, or both. Find out whether the person you’re meeting with has knowledge and experience in these areas or if you would be working with someone else at their firm.

Service and Communication

Financial professionals may offer quarterly, semiannual, or annual reviews, or may meet with clients only upon request. Regular reviews can help ensure your strategy stays aligned with your goals.

Some firms assign a lead professional, while others use a team-based approach. Clarify who you’ll communicate with regularly and how quickly they respond to inquiries.

Knowing how meetings are held can help you gauge convenience and expectations. Some clients prefer in-person interactions, while others value the flexibility to meet remotely or send and read messages at their convenience.

Not all professionals manage all aspects of their clients’ finances. Find out if others will be involved in providing advice and services and take the time to meet with them as well.

Key Questions to Consider

Some investments, such as mutual funds and annuities, have fees that are separate from the financial professional’s management fee. Ask for a breakdown of all fees so you know the total cost of the services.

Some firms charge a fee if you close your account or transfer to another provider. Ask about any such costs before committing to a relationship.

Some financial professionals collaborate with accountants, estate planners, or insurance specialists. Clarify who’s involved, their role(s), and whether you’ll incur extra charges for their services.

Financial and philanthropic professionals use several cost and fee models. Make sure you understand how your financial professional will get paid and what that means for you.

Professionals make their money in one of four ways:

- Direct Fees: You pay your professional on a flat or hourly basis or a percentage of the assets they manage. Fees for asset management average around 1% a year.

- Commissions: The financial professional earns commissions by selling financial products.

- Fees and Commissions: A combination of the above, sometimes including performance-based fees.

- Salary: Some work on salary for an institution and charge no fees or commissions.

Privacy, Continuity, and Tax Coordination

Financial professionals should use secure systems for emails, document-sharing, and data storage. Ask what cybersecurity and privacy measures are in place to keep your information safe.

If the professional is a sole practitioner, find out what happens if they retire or become unavailable. A clear continuity plan helps protect your financial future.

Certain investments, such as partnerships or alternatives, can cause delays in receiving tax forms. This might require filing for a tax extension. Ask what to expect.

Good coordination between your financial professional and other professionals, such as accountants and attorneys, can improve tax efficiency and estate planning. Ask how often they communicate and how that process works.

Regulation and Oversight

Numerous government regulators and professional organizations oversee aspects of the financial services industry, including state insurance commissioners, state and federal securities regulators such as FINRA, and credentialing organizations such as The American College of Financial Services.